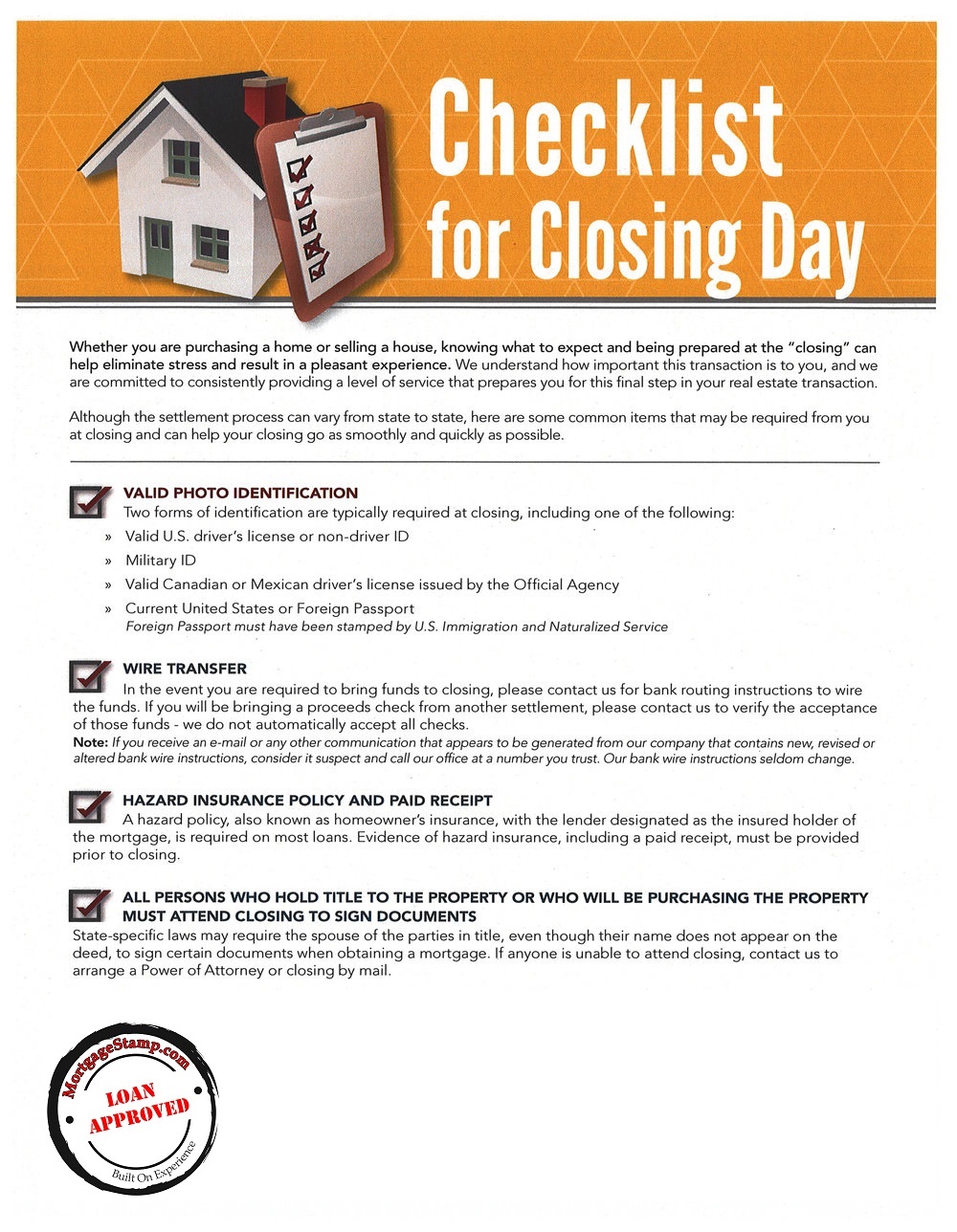

- IDENTIFICATION All parties at the closing should have a valid ID.

- POLICY OF TITLE INSURANCE You must pay for title insurance that guarantees the property is free of previous claims or liens.

- INSURANCE Before you can close on the property, you need to secure homeowner’s insurance, which insures the property in the case of damage.

- CLOSING FUNDS You must bring all funds agreed upon, in the form of a cashier’s check or via an electronic wire.

As the buyer and borrower, you will have items on your checklist that are required by your lender, the seller, and even the title company.

The closing checklist covers all the fees to be paid, the information to be provided, and the disclosures to be signed before the title is conveyed to you. Having this checklist ready helps you stay on track as a buyer, and ensures that your closing goes the way you expect.